How Estate Planning Attorney can Save You Time, Stress, and Money.

How Estate Planning Attorney can Save You Time, Stress, and Money.

Blog Article

8 Simple Techniques For Estate Planning Attorney

Table of ContentsRumored Buzz on Estate Planning AttorneyThe Facts About Estate Planning Attorney Revealed7 Easy Facts About Estate Planning Attorney ShownThe 5-Minute Rule for Estate Planning AttorneyExcitement About Estate Planning Attorney

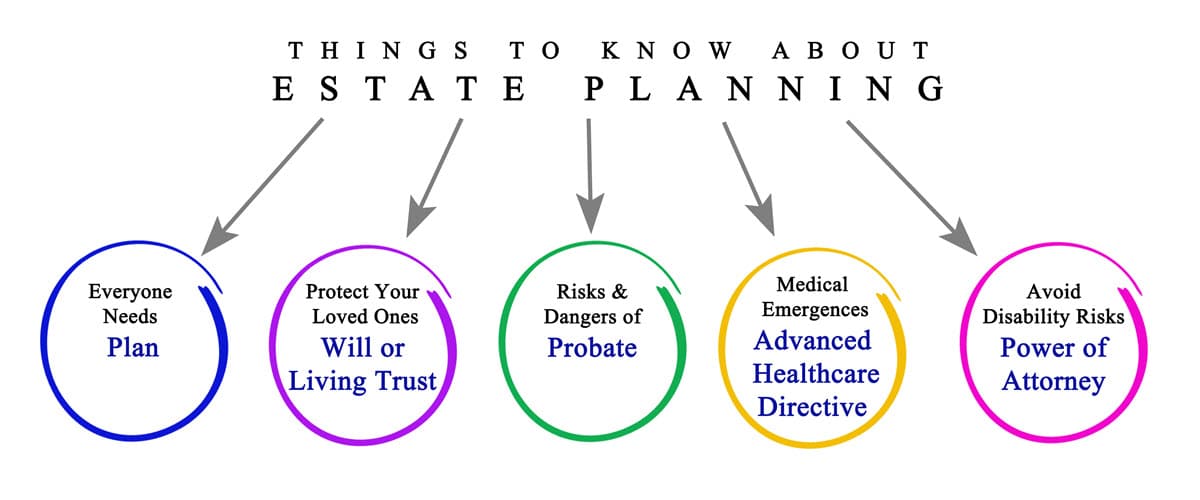

Facing end-of-life decisions and protecting household riches is a tough experience for all. In these tough times, estate preparation attorneys aid people prepare for the circulation of their estate and establish a will, trust fund, and power of lawyer. Estate Planning Attorney. These attorneys, likewise described as estate law attorneys or probate lawyers are qualified, skilled specialists with an in-depth understanding of the government and state regulations that use to how estates are inventoried, valued, distributed, and strained after death

The intent of estate planning is to appropriately prepare for the future while you're audio and capable. A correctly ready estate plan outlines your last desires exactly as you want them, in one of the most tax-advantageous manner, to stay clear of any type of questions, mistaken beliefs, misunderstandings, or conflicts after death. Estate planning is a specialization in the legal career.

Estate Planning Attorney Fundamentals Explained

These attorneys have a comprehensive understanding of the state and government regulations associated to wills and trusts and the probate process. The tasks and responsibilities of the estate attorney may include therapy customers and composing lawful papers for living wills, living trusts, estate plans, and inheritance tax. If needed, an estate planning attorney may get involved in lawsuits in court of probate in support of their customers.

, the employment of lawyers is expected to expand 9% in between 2020 and 2030. About 46,000 openings for attorneys are projected each year, on average, over the years. The path to becoming an estate planning lawyer is similar to various other technique locations.

Preferably, consider chances to acquire real-world job experience with mentorships or teaching fellowships connected to estate preparation. Doing so will certainly give you the abilities and experience to make admittance right into legislation college and connect with others. The Law special info College Admissions Examination, or LSAT, is a crucial component of using to law college.

Generally, the LSAT is offered four times each year. It is necessary to plan for the LSAT. Most potential pupils start examining for the LSAT a year in advancement, usually with a study team or tutor. Many regulation students apply for law college during the loss semester of the final year of their undergraduate research studies.

Indicators on Estate Planning Attorney You Need To Know

Typically, the yearly wage for an estate attorney in the united state is $97,498. Estate Planning Attorney. On the luxury, an estate preparation lawyer's income may be $153,000, according to ZipRecruiter. The estimates from Glassdoor are comparable. Estate intending lawyers can work at huge or mid-sized regulation companies or branch off by themselves with a solo method.

This code connects to linked here the limitations and policies enforced on wills, trusts, and other legal records relevant to estate planning. The Uniform Probate Code can differ by state, yet these legislations regulate different aspects of estate preparation and probates, such as the production of the trust or the lawful credibility of wills.

Are you unsure regarding what job to go after? It is a complicated question, and there is no simple answer. Nonetheless, you can make some factors to consider to assist make the decision easier. Sit down and note the things you are excellent at. What are your strengths? What do you delight in doing? When you have a list, you can tighten down your choices.

It entails deciding how your ownerships will certainly be distributed and who will certainly handle your experiences if you can no longer do so on your own. Estate planning is an essential component of monetary preparation and ought to be finished with the assistance of a qualified expert. There are numerous factors to think about when estate planning, including your age, health and wellness, economic situation, and family members circumstance.

The 5-Minute Rule for Estate Planning Attorney

If you are young and have few ownerships, you may not need to do much estate preparation. Health: It is an essential element to think about when estate planning.

If you are wed, you have to think about how your assets will certainly be distributed in between your partner and your heirs. It intends to guarantee that your assets are dispersed the method you want them to be after you die. It consists of taking into account any kind of tax obligations that may require to be paid on your estate.

The 8-Second Trick For Estate Planning Attorney

The attorney additionally helps the people and households produce a will. The attorney additionally helps the individuals and family members with their depends on.

Report this page